The Design Observer Twenty | Sponsored by IDEO

The Design Observer Twenty is our curated selection of twenty remarkable people, projects, and big ideas solving an urgent social need.

Esusu started by giving renters the credit they were due.

“We work with the largest owners and operators of real estate to help renters capture on-time rental payments and report it to the consumer rating agencies to help them establish and build their credit scores,” Abbey told Fortune. Then, in addition to venture capital, Esusu raised more than $1 billion in philanthropic investment capital from institutions dedicated to addressing the root causes of housing insecurity. “They usually fund homelessness when people are already on the streets,” Abbey says. “We turned around and said, ‘Why should we fund homelessness backwards?’” Esusu identifies renters who may be struggling and offers zero-interest bridge loans and other services that allow them to keep their payments current. It’s a triple win for the landlord, the tenant, and the taxpayer, Abbey says.

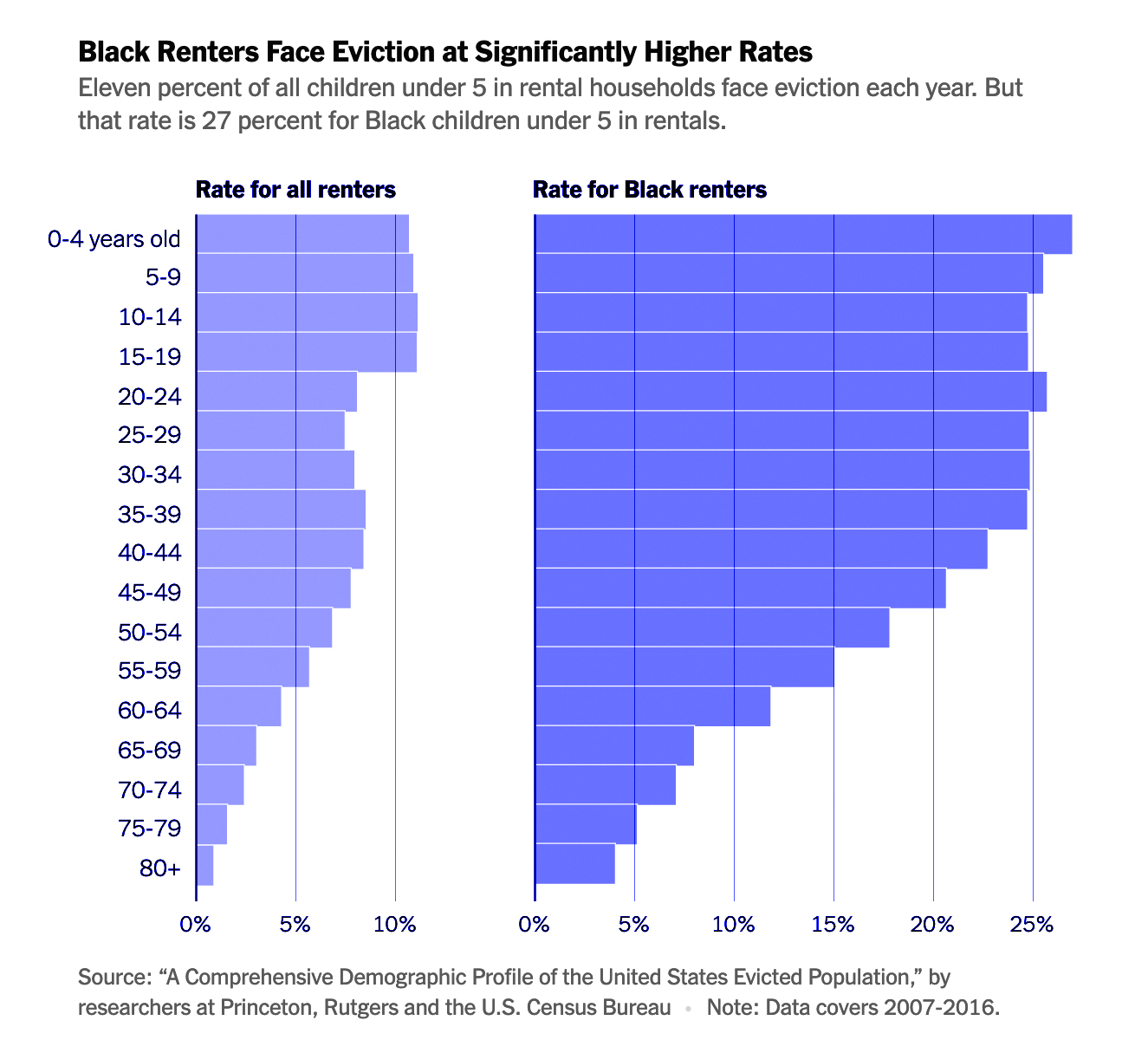

From The New York Times, "The Americans Most Threatened by Eviction: Young Children."

Esusu's leaders believe their version of justice capitalism has a meaningful role in addressing the racial wealth gap.

“We founded Esusu to dismantle barriers to housing for working families and unleash the power of data to bridge the racial wealth gap,” says co-founder and co-CEO Samir Goel. Historically, homeownership was encouraged through low or no-interest mortgages using guidelines issued by the Federal Housing Administration and then adopted by the Veterans Administration, and typically offered exclusively to white families. The legacy of those policies is segregation and wealth disparities. “Where you come from, the color of your skin and your financial identity should not determine where you end up in life.”

As it turns out, justice capitalism is good business. A Series B investment round in 2022 gave the company a $1 billion valuation, making it one of the few Black-owned unicorns in operation.

Esusu now works with over 170 property owner/operators and is monitoring over 4 million rental units across the U.S. More than 50,000 new credit scores have been established, and existing scores have increased by more than 45 points. The current average credit score for renters reporting with Esusu is 667.

The system would have helped Abbey when he emigrated from Lagos with his mother to attend high school in Minnesota. The weather wasn’t the only culture shock, he says. “My mother and I did not have a credit score, so had to borrow money at over 400% interest rate from a predatory lender.” It was a painful lesson in housing markets. “My mother sold my dad’s wedding ring. We borrowed money from church members. And that’s how we got started in the United States.”

Essay by Ellen McGirt.